The Difference Between DDU and DDP and How to Calculate It

Table of Contents

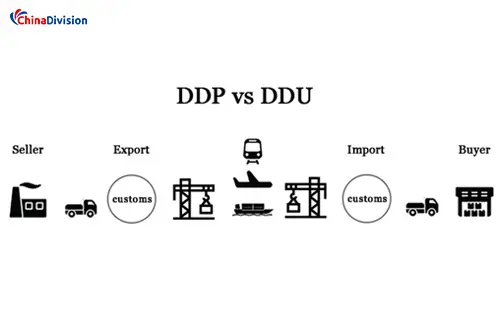

In the world of international logistics and transportation, DDU and DDP are two common trade terms that have a significant impact on the allocation of responsibilities and risks between buyers and sellers, and are essential for ensuring smooth transportation and cost savings. In this comprehensive guide, we will take a deep dive into the differences between these terms and provide insights on how to effectively calculate the associated costs to help you make informed decisions based on your logistics needs.

What is DDU?

DDU, or "delivered duty unpaid (named destination)", means that the seller is responsible for delivering the goods to the named destination, but the buyer must handle and pay all import duties, taxes, and customs clearance fees when the goods arrive. The seller bears all costs and risks of delivering the goods to the named location, excluding import duties and taxes. This term can cause complications because the buyer must manage customs clearance and related risks in the event of delays or additional costs.

When using DDU, it is important to list the details of the costs in detail and reach a written agreement to avoid disputes. Importers should clarify all the costs involved with the freight forwarder to ensure transparency and prevent unexpected costs.

Key points about DDU

The exporter delivers the goods to the named destination within the importing country.

The exporter bears the costs and risks of shipping to the named destination.

The importer is responsible for paying import duties, taxes, and other official fees.

The importer clears the goods for import.

What is DDP?

DDP, or Delivered Duty Paid (named destination), means that the seller is solely responsible for delivering the goods to the buyer, including clearing customs and paying all import duties, taxes, and fees. Under this term, the seller bears the greatest risk and cost, and it is a convenient option for buyers who are unfamiliar with customs procedures or want to avoid the associated complexities.

Using DDP is beneficial for importers, especially those new to international trade, as it minimizes risk and administrative burden. However, sellers need to ensure that they can manage the customs clearance process effectively to avoid delays and additional costs.

Key points about DDP

The exporter ships the goods to the named destination within the importing country.

The exporter bears the costs and risks of shipping to the named destination.

The exporter is responsible for paying import duties, taxes, and other official fees.

The exporter clears the goods for import.

Understanding how to calculate the cost of DDU and DDP is essential to making an informed decision.

DDU and DDP cost calculation method

DDU calculation method: CIF amount + local costs at the destination port

DDP calculation method: CIF amount + local costs at the destination port + import duties and taxes

Where CIF (cost, insurance and freight) amount calculation method: all transportation costs at the export port + local costs (positive or negative) + FOB amount (free on board, which is the cost of the goods, including all local costs and transportation costs at the export port)

DDU vs. DDP: Which is better?

The choice between DDU and DDP usually depends on the preferences and risk tolerance of importers and exporters. The choice of DDU or DDP depends on a variety of factors, including the experience of the buyer, the complexity of the customs process in the destination country, and the nature of the goods being transported.

Risk management: DDP transfers the risks and responsibilities associated with import customs clearance to the exporter, which is beneficial to importers, especially those who are new to international trade or deal in goods that are susceptible to import restrictions or trade barriers.

Cost impact: While DDU may initially appear cheaper, unexpected brokerage fees, storage fees, and late fees can significantly increase the overall cost to the importer. DDP offers a more predictable cost structure, with a fixed fee paid upfront to the courier.

Customer experience: DDP shipping eliminates the need for importers to deal with unexpected customs fees, ensuring a smoother customer experience and reducing the likelihood of goods being abandoned at customs.

DDU may appear more economical at checkout, but customers may be surprised by the sudden need to pay tariffs, which may affect the customer experience. While DDP has a higher upfront fee, the fee is fixed and it avoids customers dealing directly with customs, reducing the risk of goods being detained or abandoned by customs.

Key differences and choices between DDU and DDP

Understanding the pros and cons of DDU (Delivered Duty Unpaid) and DDP (Delivered Duty Paid) is essential to optimizing your international shipping strategy. As a professional international logistics and transportation service provider, ChinaDivision has compiled these differences so that you can quickly choose the option that best suits your business model. The following is a detailed introduction to professional logistics and transportation services.

Advantages and Disadvantages of DDU Shipping

Advantages for Sellers

Simplified Checkout Process: Sellers don’t have to configure their checkout system to calculate taxes, which simplifies online store operations.

Control for Buyers: Regular importers can benefit from more control over their shipping experience, especially if they are familiar with their country’s customs procedures.

Competitive Pricing: DDU can lower checkout prices, which can reduce shopping cart abandonment rates due to additional fees such as shipping, taxes, and handling. According to research by the Baymard Institute, these additional fees are the leading cause of shopping cart abandonment in e-commerce. Lower checkout prices can give you a competitive advantage.

Disadvantages for Buyers

Unexpected Fees: Buyers are responsible for any duties and taxes upon delivery, which can lead to unpleasant surprises if not clearly communicated during the purchase process.

Delayed Delivery: Since customs clearance is not handled in advance, buyers may experience delays before receiving notification that their package is ready for pickup.

Likelihood of Complaints: Even when responsibility for duties and taxes is clearly stated, merchants offering free shipping services may face a high number of customer complaints. Given that DDU is uncommon in e-commerce, unexpected fees can lead to a negative customer experience.

Advantages and Disadvantages of DDP Shipping

Advantages for Buyers

Convenience: Buyers only need to pay for their orders and wait for the goods to be delivered, and the seller will take care of the entire import and export process. This includes all duties, taxes, and customs clearance fees.

Positive Customer Experience: DDP's high service standards increase customer satisfaction, trust, and loyalty. Sellers control the shipping process, providing a consistent experience for returning customers.

Disadvantages for Sellers

Complex customs requirements: Sellers must understand customs regulations and tax requirements in different countries, which can be complex and time-consuming.

Higher Risk and Liability: Sellers bear all risks associated with shipping, from lost goods to damaged items.

Reduced Flexibility for Buyers: Buyers have no control over delivery speed, package carrier selection, or shipment tracking. This can cause anxiety, especially when there is a lack of post-sale communication from the merchant.

VAT and Customs Clearance in DDP

VAT is included: DDP shipping rates include VAT unless otherwise specified by the shipper. Sellers should confirm VAT requirements before offering DDP to accurately calculate shipping costs and profit margins.

Customs Clearance: The DDP trade term requires the seller to handle customs clearance, including related fees. These costs must be thoroughly researched and considered to ensure they do not negatively impact overall shipping costs and profitability.

DDP is often a better option for inexperienced importers or those who prefer a hassle-free process.

DDU can result in unexpected costs and delays that can negatively impact the buyer’s experience.

Choosing DDU or DDP depends on your business model, your customers’ experience level, and the nature of your products. DDU can provide cost savings and control for experienced buyers, while DDP provides convenience and a seamless customer experience that increases satisfaction and loyalty.

DDU and DDP each have their pros and cons, and the choice should be based on a comprehensive consideration of cost, risk, and customer service. As an expert in international logistics, ChinaDivision is able to assist you in evaluating various factors, selecting the trade terms that best suit your business, and providing professional logistics services.

At ChinaDivision, we understand the complexities of international logistics and strive to provide professional and reliable services to meet your specific needs. Whether you choose DDU or DDP, our experienced team will guide you through the entire process, ensuring seamless operations and cost-effective shipping solutions.

To further discuss your logistics needs, optimize your supply chain and ensure that your goods reach their destination smoothly and economically, please contact us. Our team of experts will provide you with personalized consultation and solutions.

ChinaDivision - Your reliable international logistics partner.

Contact information:

Official website: Visit our official website to learn more about our services and prices.

Social media contact: Communicate with our professional customer service team in real time through Facebook or LinkedIn.

Email: Send an email to our customer service [email protected] and we will respond to your inquiries and needs as soon as possible.

Let us work together to escort your international trade.