In-depth Comparison Guide of Cargo and Freight Insurance

Freight Insurance and Cargo Insurance are two common forms of logistics insurance, which often confuse B2B companies when choosing. Faced with multiple modes of transportation such as sea and air, companies are often unclear about which insurance to choose to protect their interests. This article will explore the definitions, coverage, liability attribution and differences between these two types of insurance in depth to help you make wise decisions in the international logistics process.

Table of Contents

- What is Freight Insurance?

- What is Cargo Insurance?

- What does Cargo Insurance cover?

- Who is responsible for buying Cargo Insurance?

- Freight Insurance vs. Cargo Insurance

- Cargo Insurance Coverage

- What does cargo insurance cover?

- Choose the Right Type of Insurance

- What factors does the cost of cargo insurance depend on?

- Common Mistakes to Avoid When Purchasing Cargo Insurance

What is Freight Insurance?

Freight Insurance mainly protects against freight losses caused by various reasons (such as natural disasters, accidents, etc.) during the transportation of goods. This type of insurance is usually aimed at the transport party (such as freight forwarders, carriers, etc.) to compensate for freight losses caused by cargo loss or delays. Many people mistakenly believe that the carrier's liability insurance will fully protect them, but in fact, the carrier's liability insurance is usually not enough to cover the full value of the goods.

What is Cargo Insurance?

Cargo Insurance is insurance designed specifically for the goods themselves. It covers a wider range, including but not limited to the risks of loss, damage, theft, waterlogging, fire and other risks of goods. Whether it is sea, air or land transportation, as long as the goods are lost during transportation, Cargo freight Insurance can provide corresponding compensation.

What does Cargo Insurance cover?

Cargo Insurance covers a very wide range, mainly including the following aspects:

Marine risks: such as natural disasters and accidents such as running aground, sinking, fire, explosion, etc.

External risks: such as theft, war, strikes, coups and other human factors that cause cargo losses.

Particular average: refers to the partial loss of goods caused by the risks within the scope of insurance, and this part of the loss shall be borne by the damaged party.

General average: refers to the loss and expenses caused by reasonable measures taken intentionally to save the ship and cargo, and this part of the loss shall be shared by the shipowner, the cargo owner and the freight payer.

Who is responsible for buying Cargo Insurance?

In international logistics, the responsibility for cargo insurance usually depends on the contractual agreement between the buyer and the seller. Generally speaking, the shipper or consignee can purchase cargo freight insurance as needed to protect their own interests. In some cases, the buyer may require the seller to provide cargo insurance as one of the transaction conditions.

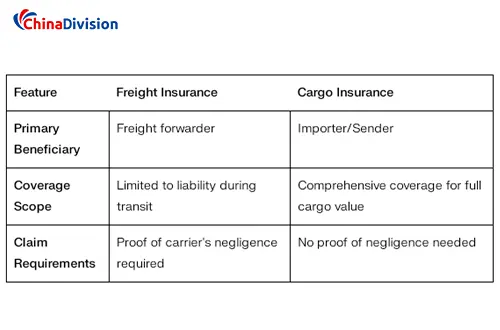

Freight Insurance vs. Cargo Insurance

Different objects of coverage

Freight shipping Insurance protects against freight losses, while Cargo Insurance protects the goods themselves.

Different coverage

Freight insurance is usually purchased by the carrier, mainly to protect the carrier's liability for loss or damage to the goods during transportation. Cargo insurance is usually purchased by the cargo owner, protecting the cargo owner for the full value of the goods during transportation.

Different liability

Freight Insurance is usually purchased by the transporter, while Cargo Insurance can be purchased by the shipper or consignee according to the contract.

Essentially, freight shipping insurance may include cargo insurance as one of its components, but it also provides more comprehensive protection for other logistics challenges.

Cargo Insurance Coverage

Cargo freight insurance coverage can be customized according to specific needs, and common coverage includes:

Marine Cargo Insurance: protects goods transported by sea, covering risks such as marine accidents, natural disasters, piracy, etc.

Air Cargo Insurance: protects goods transported by air, covering risks such as air accidents and weather factors.

Land Cargo Insurance: Protects cargo that is transported via land transportation, covering risks such as traffic accidents, theft, etc.

What does cargo insurance cover?

Cargo insurance covers a range of risks, depending on the type of policy you choose. Common coverage includes:

Accidental Damage: Cargo can be damaged during transportation due to accidents, including collisions, rough handling, or unforeseen events.

Theft: Cargo can be stolen during transportation, whether it is in a warehouse, in transit, or at the port.

Natural Disasters: Events such as storms, floods, earthquakes, or other environmental disasters can damage or destroy your cargo.

Cargo Loss: Cargo can be lost due to miscommunication, misplacement, or accidents during transportation.

In addition, cargo insurance may also cover other risks, such as unexpected expenses, storage costs during delays, or protection from political unrest in the area where the cargo is transported.

Choose the Right Type of Insurance

Choosing the right type of insurance is crucial depending on the specific needs of your business and the nature of your cargo. Here are some common types of insurance:

Excess Cargo Insurance

Provides additional insurance coverage for cargo that exceeds the basic insurance limits. If the value of your cargo exceeds the typical limits of a regular policy, you may need excess insurance to ensure comprehensive coverage.

For example, if your cargo is particularly valuable or is being shipped through high-risk areas, excess cargo insurance can provide more comprehensive protection. When deciding whether excess insurance is needed, it is important to assess the value of your cargo and the risks involved in the shipping route.

International Cargo Insurance

Protects the safety of your cargo during international shipping, covering shipping risks around the world.

What factors does the cost of cargo insurance depend on?

The value of the cargo: Higher-value cargo generally requires higher premiums.

Mode of transport: Rates for ocean and air freight may vary, depending on the risks involved with each mode of transport.

Destination: Certain regions or countries may present higher risks, resulting in higher premiums.

Type of cargo: Perishable or dangerous goods may incur higher insurance costs due to the additional risks involved.

It is important to weigh the cost of insurance against the potential financial risk of cargo damage or loss. For most businesses, the peace of mind that comprehensive cargo insurance brings is worth the investment.

Common Mistakes to Avoid When Purchasing Cargo Insurance

Underinsurance of Your Cargo

Failure to insure the full value of your cargo may result in significant out-of-pocket expenses if your cargo is damaged or lost.

Choosing Inadequate Insurance Coverage

Some policies may have exclusions that leave your cargo unprotected in certain events or in specific areas.

Neglecting to Read the Fine Print

Always check the terms and conditions of your insurance policy to ensure you understand the coverage and any potential exclusions.

Relying on Default Carrier Insurance

Although convenient, default insurance may not always provide comprehensive protection. Consider purchasing additional insurance that suits your needs.

In the international logistics process, in order to ensure the safety of your cargo, companies should choose the appropriate type of insurance according to their needs. If your cargo is of high value or has a high risk of transportation, it is recommended to purchase Cargo Insurance to fully protect the safety of your cargo. At the same time, working with a professional logistics service provider is also an effective means of reducing risks. ChinaDivision has extensive international logistics experience and a professional insurance service team, able to provide you with a full range of logistics insurance solutions.

If you have any questions or needs regarding international logistics insurance, please feel free to contact ChinaDivision. Our professional team will provide you with detailed consultation and customized insurance service solutions to ensure that your goods are fully protected during transportation.

Through the detailed analysis of this article, I believe you have a deeper understanding of Freight Insurance and Cargo Insurance. In the process of international logistics, choosing the right type of insurance is crucial to protecting the interests of the company. If you are looking for reliable guidance to choose the right cargo insurance for your goods, please contact Chinadivision immediately. Our expertise in international logistics can help you get comprehensive protection that meets your specific needs. ChinaDivision looks forward to working with you to create a safer and more efficient international logistics system.