Tax-inclusive Vs. Tax-exclusive: Amazon Fba Shipping Options

Choosing the right shipping mode, especially deciding whether to choose tax-inclusive or tax-exclusive services for Amazon FBA shipping, is crucial for cost control, tax compliance, and overall supply chain efficiency. Due to different tax regulations in different regions and countries, it is important to clearly understand the difference between FBA tax-inclusive and tax-exclusive shipping.

Table of Contents

- Common pain points in Amazon FBA shipping

- What is Amazon FBA shipping?

- The difference between tax-inclusive and tax-exclusive ocean shipping

- When should you consider tax-inclusive shipping?

- When should you consider tax-exclusive shipping?

- How to choose whether Amazon covers tax or not?

- Partner with Chinadivision for expert guidance

Common pain points in Amazon FBA shipping

Confusion about tax responsibilities, especially when state laws and Amazon policies vary. Sellers often encounter unexpected shipping costs, especially when taxes are not included in shipping costs, which can lead to budgeting issues.

Storing inventory in Amazon distribution centers can create sales tax source complexities, complicating tax obligations and compliance.

What is Amazon FBA shipping?

Amazon FBA shipping refers to a logistics method for shipping goods from China to Amazon warehouses in the United States. There are two main modes of FBA shipping: tax-inclusive and tax-exclusive.

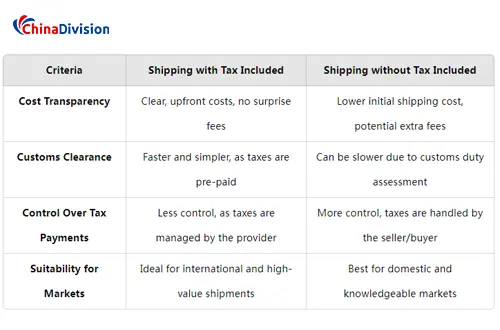

The difference between tax-inclusive and tax-exclusive ocean shipping

Tax-inclusive ocean shipping

refers to logistics companies providing one-stop services including customs clearance, tariff payment, etc. In this model, sellers do not need to worry about tax and customs clearance issues in the destination country, and all costs are usually included in the logistics quotation, which simplifies the operation process and reduces direct tax risks.

When tax-inclusive, Amazon handles the calculation and collection of sales tax on your behalf. Your product price will reflect the final cost to the customer, including taxes. Amazon will adjust your inventory level based on the total sales price including taxes.

Tax-exclusive ocean shipping

requires sellers to handle customs clearance and tariff payment on their own. This approach provides greater flexibility, allowing sellers to optimize tax strategies based on the specific circumstances of the goods and market changes. However, it also means that sellers need to have the corresponding tax knowledge and processing capabilities to deal with possible complex situations.

When tax-exclusive, you are responsible for calculating and charging sales tax to customers. Your product price does not include tax, and customers will pay the tax at checkout. At the same time, you need to track inventory levels separately and adjust them based on sales and tax calculations. Tax-exclusive may cause Witkey to be surprised by additional taxes at checkout, which may affect their purchasing decisions.

When should you consider tax-inclusive shipping?

For International Shipments

When shipping to international customers, especially in countries with strict customs regulations and high import taxes, choosing tax-inclusive shipping is more efficient and predictable.

For New Market Entry

If you are new to a market and want to ensure a smooth customer experience with no unexpected fees, choosing tax-inclusive shipping can help you avoid unhappy customers due to unexpected tax bills.

For High-Value Products

When shipping high-value products, any delays or additional fees due to taxes can affect customer satisfaction and sales. Including taxes in shipping costs can provide peace of mind for both sellers and buyers.

Benefits of Tax-Inclusive Model

Simplified process: Sellers don’t have to deal with complex customs clearance procedures, saving time and effort.

Transparent costs: Knowing all costs in advance makes it easier to budget and price.

Reduced risk: Avoid delays and fines caused by customs clearance issues.

When should you consider tax-exclusive shipping?

For Domestic Shipments

If your goods are in the same country or region and the tax regulations are simple, tax-inclusive shipping may be more cost-effective.

For businesses with tax expertise

If your business has a dedicated team or a partner with expertise in tax regulations, you can optimize costs by managing taxes separately.

For B2B transactions

In some B2B scenarios, buyers may have special tax arrangements or are responsible for their own import duties, so tax-free shipping is a more practical option.

Advantages of the tax-free model

High flexibility: Sellers can choose the most appropriate customs clearance solution based on actual conditions.

Potential cost savings: If the tariff of the product is low, it may be more economical to choose the tax-free model.

Liquidity: Sellers can take advantage of exchange rate changes and tax incentives to increase liquidity.

How to choose whether Amazon covers tax or not?

Tariff costs

If the tariff costs are expected to be high or you want to simplify the operation process, the tax-free model may be more appropriate. On the contrary, if the tariff is low or there is a special tax strategy, the tax-free model may be more advantageous.

Sales volume

Sellers with large volumes can simplify the customs clearance process and reduce time and trouble by choosing the tax-free model. Sellers with small volumes can flexibly choose logistics companies and transportation methods by choosing the tax-free model.

Product type and tariff rate

Different types of goods have different tariff rates. For products with higher tariffs, choosing the tax-inclusive model can avoid the risk of customs inspection and fines, while for products with lower tariffs, choosing the tax-free model may be more economical.

Business Structure

If you are a seller located in a jurisdiction where Amazon handles taxes, choosing the tax-inclusive model may be more convenient.

Operational Complexity

The tax-free model requires sellers to handle customs clearance and taxes on their own, which may involve additional time and resource investment. If you lack relevant experience, the tax-inclusive model may be a more worry-free option.

Target Market

If you sell products to customers in areas with complex tax regulations, the tax-inclusive model can simplify the process.

Risk Control

The tax-inclusive model transfers tax risks to logistics companies, while handling customs clearance on your own requires sellers to bear the risks themselves. You need to assess your own risk tolerance and management capabilities.

Liquidity

The tax-free model may reduce capital occupation in the short term because tariffs and customs clearance fees can be paid in batches according to actual conditions. The tax-inclusive model requires more fees to be paid upfront.

Partner with Chinadivision for expert guidance

Handling the complexity of Amazon FBA shipping can be challenging. This is where Chinadivision comes in. Our team of experts can provide valuable insights, guidance and support to help you optimize supply chain management, reduce costs and improve efficiency. Whether you choose tax-inclusive or tax-exclusive services, we provide the following support:

Customized logistics solutions

Provide personalized logistics solutions based on your specific needs.

Tax and customs clearance consulting

Provide professional tax and customs clearance consulting services to help you make informed decisions.

Real-time cargo tracking

Ensure that you are always aware of the status of your goods through advanced tracking systems.

We are committed to becoming your trusted logistics partner and jointly promoting the sustainable development of your business. If you have any questions about Amazon FBA shipping or need professional logistics advice, please contact us.