Differences in the Number of Digits in Hs Codes of Different Countries

In international trade, customs codes (HS Codes) are an important tool for classifying goods and determining tariff rates. Customs codes (Customs Codes) not only determine the import tax rate of goods, but also affect the transportation billing, trade statistics, and the transmission of commodity information. However, there are differences in the number of digits in HS codes of different countries, which often brings confusion to B2B companies in logistics transportation and tariff calculations. From the perspective of a professional third-party fulfillment service provider, this article will explain in detail the definition and structure of HS codes, and explore the differences in the number of digits in customs codes of different countries to provide you with clear guidance.

Table of Contents

- What is a transport HS code?

- The number of digits in the internationally accepted HS code

- The difference in the number of digits in customs codes of different countries

- What are the factors that affect the number of digits in the customs code?

- What impact does the difference in the number of digits in the customs code have on logistics and customs clearance?

- How to check the customs code for a specific commodity?

- How to ensure the accuracy of customs codes to avoid goods being detained or paying back tariffs?

- How to deal with differences in customs codes in different countries?

What is a transport HS code?

The transport HS code, or Harmonized System Code, is an international commodity classification system developed by the World Customs Organization (WCO). It is a commodity classification and coding system widely used in international trade, which provides a unified commodity identification standard for countries in customs, statistics, trade, transportation, etc., and aims to promote the standardization and facilitation of international trade.

The number of digits in the internationally accepted HS code

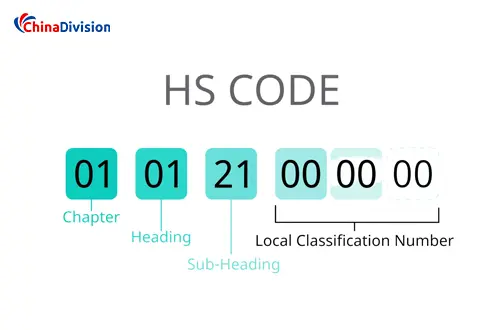

The internationally accepted HS code usually consists of 6 digits, which cover 22 categories and 98 chapters of goods, and are further divided into headings and subheadings. Among them, the 1st-2nd digits represent "class, chapter", the 3rd-4th digits represent "heading", and the 5th-6th digits represent "subheading".

The difference in the number of digits in customs codes of different countries

Although the international standard is 6 digits, countries have expanded the HS code according to their own needs. This difference is mainly reflected in the following aspects:

Difference in digits

China: uses a 10-digit code, the first 6 digits are equivalent to the internationally accepted code, and the 7th-10th digits are Chinese subheadings, which are classified and extended according to the actual situation of China's import and export commodities. In addition, after the merger of China Customs and the inspection and quarantine department, the customs commodity code was expanded to 13 digits, and the 11th-13th digits were called CIQ additional codes for import and export inspection and quarantine declarations.

Germany: German customs requires that there must be a 6-digit or no less than 4-digit HS code in the cargo manifest.

Italy: Italian customs requires that all goods to Italy and transiting there must provide a 6-digit HS code.

The United States, Spain, and South Korea: use 6-digit codes.

Bangladesh, the United Kingdom, and Pakistan: use 8-digit codes.

Turkey: use 12-digit codes.

Other countries: Different countries have different requirements for the number of digits in the HS code, and some countries may require 4 or more digits. This difference may result in different HS codes being used for export declarations and import customs clearances, and companies need to declare separately according to the requirements of the exporting and importing countries.

Specific requirements

In addition to the difference in the number of digits, different countries may also have different specific requirements for HS codes. For example, some countries may require specific additional information or meet specific format requirements.

Differences in interpretation and application

Although the HS code is unified internationally, different countries may have different specific interpretations and applications of the code. This is mainly reflected in tax rates, regulatory conditions, and other management regulations.

What are the factors that affect the number of digits in the customs code?

National policies and regulatory needs

Countries expand the HS code according to their own policies and regulatory needs.

Refinement of commodity classification

Some countries may require more detailed commodity classification to accommodate specific tax policies or regulatory requirements.

International trade cooperation

In international trade cooperation, countries need to ensure that their customs coding systems are consistent with international standards while meeting domestic needs.

What impact does the difference in the number of digits in the customs code have on logistics and customs clearance?

Classification accuracy

Misclassification of goods due to HS code mismatches may result in customs delays, fines, or even confiscation of goods. For example, a country may require an 8-digit code, but if you submit a 6-digit code, it may result in delays or incorrect tariff assessments.

Duties and taxes

The more detailed the HS code, the more accurate the assessment of duties and taxes. For example, a 10-digit US code is generally more accurate in calculating tariffs than a 6-digit HS code.

Customs clearance time

The more precise the code, the faster and smoother the customs clearance process. Detailed codes reduce the possibility of resolving disagreements with customs authorities, thereby speeding up delivery times.

Compliance

Using the wrong customs code may cause your goods to be marked for inspection, resulting in compliance issues and unnecessary delays. Incorrect codes can also lead to misapplication of trade agreements, which can affect the cost of your goods.

How to check the customs code for a specific commodity?

You can check it through the official website of each country's customs, the database of the International Trade Organization, or professional customs brokers and freight forwarders. In China, you can visit China Customs Clearance Network or the official website of the General Administration of Customs for inquiry.

How to ensure the accuracy of customs codes to avoid goods being detained or paying back tariffs?

When declaring customs codes, be sure to ensure the accuracy of the codes. You can declare through professional customs brokers or freight forwarders, who usually have rich experience and expertise and can provide you with accurate coding suggestions.

In addition, you can also communicate with customs to confirm the accuracy and applicability of the codes.

How to deal with differences in customs codes in different countries?

When conducting international trade, be sure to understand the customs code regulations and requirements of the destination country. You can communicate with the customs, customs brokers or freight forwarders of the destination country to obtain accurate information and guidance.

In addition, you can also consider working with professional third-party fulfillment service providers, such as Chinadivision, who usually have rich experience and expertise in international trade and can provide you with comprehensive trade services, including customs code query, customs declaration, transportation, etc.

For B2B companies, it is crucial to understand and apply the correct HS code. As a professional third-party fulfillment service provider, Chinadivision can help companies accurately classify goods and ensure the correct application of customs codes, thereby avoiding unnecessary delays and additional costs.

The difference in the number of digits in customs codes is a complex issue in international trade, which involves multiple aspects such as commodity classification, tariff calculation and regulatory compliance. If you encounter questions or confusions related to customs codes in international trade, please contact Chinadivision. As a professional third-party fulfillment service provider, we will provide you with comprehensive trade services to ensure the smooth customs clearance of your goods and promote the smooth progress of international trade.